When running a business in Singapore, doing your payroll is more than just counting the hours your workers have completed over the week, figuring out everyone’s wages, and issuing them to each person. As part of your payroll duties, you must follow all the relevant rules set out by the Singapore government. You must make deductions about withholding tax and employee benefits and ensure that money is paid into the social security fund. This is a lot of work to be done by yourself, so it makes a lot more sense to hand over all this responsibility to a third party that knows what it is doing.

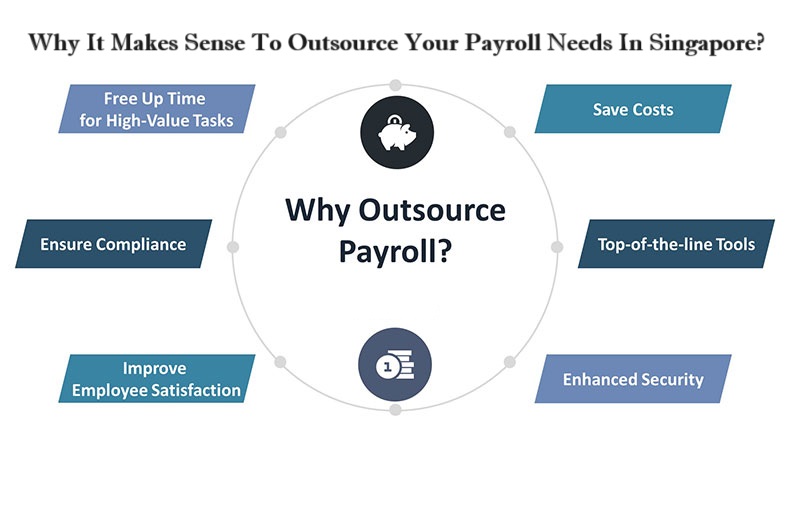

Why It Makes Sense To Outsource Your Payroll Needs In Singapore?

This is why you need to look for a payroll services company in Singapore that can help guide your business in the right direction. Working together can help the whole productivity of your business enterprise. If you’ve never considered hiring a third party to do your payroll services for you, then the following are just some of the numerous benefits of doing so.

Payroll Services – Why Outsource In Singapore?

It helps to reduce your costs –

Suppose you try to do the business payroll all by yourself. In that case, you are considering considerable costs in doing everything, including having the essential software, printing payment checks, and ensuring you follow all the rules. Hiring a third party to do all of this for you is much more cost-effective, and you will save yourself a considerable amount of money over the long term.

You get to enjoy their expertise –

There are many external factors at play when you have a business in Singapore, and as well as having to hold back money for relevant taxes, you need to make sure that you have the most up-to-date forms that need to be filled in and that you are following Singapore payroll laws. It would take a great deal of knowledge to keep yourself up-to-date with these numerous changes, so you always turn to an experienced payroll service provider because this is what they specialize in.

Risk reduction & no penalty fees –

Many employers in Singapore always make mistakes, and even though they are not deliberate, they lead to incorrect filings and payments about the payroll system. As an employer, you are required to pay the necessary taxes, and if you do not fill in the relevant paperwork to meet all of these requirements, you will get a financial penalty. By hiring experts to take care of your payroll services, you can avoid such penalty fees, reducing your risks exponentially.

It frees you & your staff members up –

If you are trying to process your payroll needs and asking your staff to take part as well, then it’s likely that you’re taking them away from the jobs you had them to do in the first place. The company suffers because they are not giving their full attention to what you hire them to do, and it is also taking you away from the core of your business. It is your job as the owner to increase your customer base and develop new ideas to increase profits.

Conclusion

It is also likely that your technology will be limited when it comes to doing your company payroll. You can also take advantage of their other services, like keeping track of attendance, enrolling employees in benefits, and many more. All of this will help to cut down on your costs and help to increase efficiency within your payroll department, and add security as well.